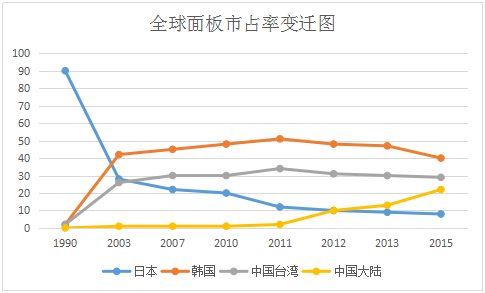

In the 1990s, the LCD panel industry was basically monopolized by Japanese manufacturers. In the early 1990s, the global market share of Japanese TFT LCD panels rose from 90% to 94% in four years. At that time, more than 60% of the world's LCD panel factories were in Japan. At that time, the LCD technology was just starting, and the main production lines below the 3rd generation line were Mitsubishi, Sharp, Hitachi, Toshiba, Sanyo, Epson, NEC, Panasonic and Sony. Before China entered the LCD industry, this LCD product was almost controlled by Japanese, Korean and Taiwan Province enterprises. They not only made a lot of money from this LCD screen, but also imposed various restrictions on the production, R&D and application of our products to LCD screens. When the LCD industry was opened up by China people, the psychology of all players in the LCD industry has changed. Among them, Sharp, Samsung, LG and Chi Mei (Taiwan Province) have all abandoned the blockade strategy to build a high-generation LCD panel production line in Chinese mainland. I'm afraid Chinese mainland can only submit to humiliation if I don't think LCD panels have the capacity of Huaxing Optoelectronics and BOE. Now it has realized the value of independence. Based on the current capacity planning, the total shipments of China's panel enterprises will surpass that of South Korea in 2018.

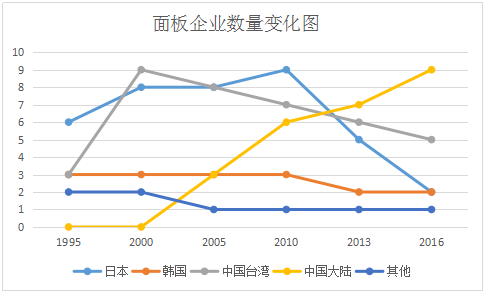

Change chart of the number of global panel enterprises over the years

Change chart of global panel market share over the years

Mitsui Empire laid out BOE and Kunshan Longteng in November, 1998. Mitsui & Co., Ltd. keeps an eye on the changes of the global information industry through the developed commercial network, and provides a solid foundation for the expansion of Japanese consortium enterprises. A careful look at more than 80 trading customers of Mitsui Information Electronics Co., Ltd. (formerly MBK Microtek Company) under Mitsui & Co., Ltd. reveals many familiar names, including Toshiba, Sony, NEC, Fujitsu, Panasonic, mitsubishi electric, Canon, Sanyo Electric, Sharp, IBM, fujifilm, CPT (Taiwan), Samsung (Korea), LG (Korea) In November, 1998, the pilot project of Jilin Caijing Digital Hi-Tech Display Co., Ltd. (referred to as Jilin Caijing), the first Sino-foreign joint venture in Chinese mainland to produce TFT-LCD and display modules with a planned investment of 100 million yuan, was completed, behind which was the mature large-scale production technology and equipment imported from DTI Company of Japan. The partners of the project are Mitsui & Co., Toshiba, IBM of Japan, DTI, Marubeni and Sanyo Electric Co., Ltd., joint ventures of Toshiba and IBM, and a number of Japanese technical equipment developers with senior experience in TFT-LCD field have been employed. Liquid crystal industry is a capital-intensive industry, and many insiders describe it as a super-burning industry. Therefore, after the establishment of Jilin Caijing, the biggest problem is undoubtedly the funding problem. On July 3rd, 2000, "Tonghai Hi-Tech" with the mission of making money appeared. It held the "trump card" of LCD, the key project of the ninth five-year plan of China, and held the aura of Jilin electronic enterprise leader, and issued 100 million public shares. However, after receiving reports of illegal fund-raising from insiders, the CSRC issued a notice to suspend its listing, and Jilin Caijing died almost before it was officially put into production. The failure of "Jilin Caijing" project did not stop Mitsui's layout in China LCD industry. On November 18th, 1999, under the organization of Mitsui & Co., Ltd., "Shanghai Radio and Television LCD Co., Ltd." (abbreviated as Radio and Television LCD) was formally established. This joint venture company is jointly invested by Mitsui & Co., Ltd., Shanghai Radio and Television Electronics Co., Ltd., a subsidiary of Shanghai Radio and Television Co., Ltd., and Japan's Kanda Industry Co., Ltd., with a registered capital of $10,000, of which Mitsui & Co., Ltd., Shanghai Radio and Television Electronics Co., Ltd. and Kanda Industry Co., Ltd. account for 25%, 70% and 5%, mainly engaged in the manufacture and sale of small and medium-sized flat panel displays, which are suitable for mobile phones At the beginning of 2004, in order to meet the needs of important users in Beijing and Shanghai, Mitsui Information Electronics (Shanghai) Co., Ltd., a subsidiary of Mitsui & Co., Ltd., cooperated with China Electronic Import & Export International Electronic Services Co., Ltd. (CIES), and CIES established consignment bonded warehouses in Yizhuang Economic Development Zone in Beijing and Zhangjiang in Shanghai. Among them, Beijing Bonded Warehouse is located in Beijing Customs Zhongdian Yizhuang Bonded Center, with an area of about 250 square meters; Shanghai Bonded Warehouse is located in Shanghai Zhangjiang CLP Bonded Center, and its main function is to reserve spare parts, provide spare parts borrowing and other related maintenance consignment services. Then, in August, 2004, Mitsui Information Electronics (Shanghai) Co., Ltd. and Zhipu Electromechanical (Shanghai) Co., Ltd. respectively signed formal admission agreements with Beijing University of Technology Software Park in Beijing Economic and Technological Development Zone, and set up technical support and after-sales training centers in the park. As a result, Mitsui consortium has linked LCD flat-panel TV business in Shanghai and Beijing. It is worth noting that Mitsui Information Electronics (Shanghai) Co., Ltd. is mainly engaged in the production and technical services of liquid crystal display (TFT-LCD) and related accessories, semiconductor equipment and other related products, and is the main production equipment supplier of "BOE TFT-LCD Project". "BOE TFT-LCD Project" broke ground on September 26, 2003, and it is the 5th generation TFT-LCD production line with an investment of USD 100 million by Beijing Oriental Science and Technology Group (BOE). BOE spent RMB billion of its own funds and RMB billion of credit funds, totaling RMB billion, and completed the integration of TFT-LCD technology and sales and service system. The fifth generation line of BOE was put into operation in the first quarter of 2005, and all raw materials and accessories were imported. As the production cost is too high, the panel market price drops rapidly, the industry upgrades rapidly, and the competition among foreign peers intensifies. BOE has been losing money since it started construction. On March 2, 2005, Marubeni Corporation (referred to as Marubeni) invested RMB 100 million to become a strategic investor of BOE by purchasing 10% shares of Beijing BOE Investment Development Co., Ltd., the parent company of BOE, and sent a director to participate in the management of BOE. Marubeni and BOE started to cooperate in the components of color picture tube (CRT) in the early 1990s, and participated in the establishment of "Beijing Xuxiaozi Electronic Glass Co., Ltd." (1993). Marubeni has been paying close attention to the TFT-LCD business of BOE, so it has formed a working group to follow up BOE for a long time. Marubeni signed the Strategic Cooperation Agreement with BOE on the same day that it took part in BOE Investment Development Co., Ltd.. According to the content of the agreement, Marubeni introduced the information of raw materials and parts needed for the production of TFT-LCD to BOE, and provided stable and competitive raw materials and parts supply services to BOE's TFT-LCD factories as required, helping to attract overseas TFT-LCD parts and materials manufacturers to invest and provide local matching. To this end, BOE easily handed over the right to purchase raw materials to Marubeni.